Dupont formula roi

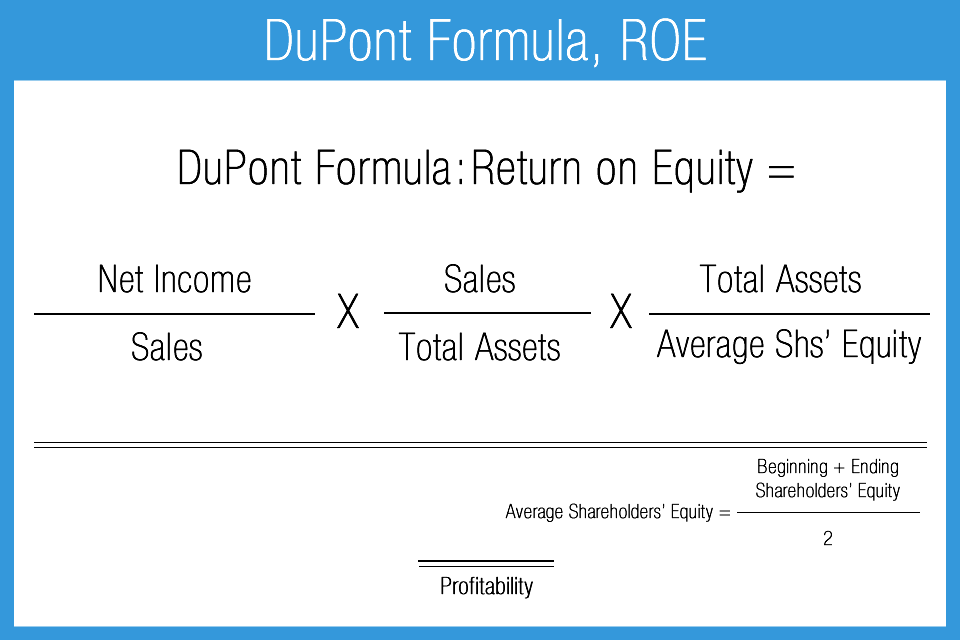

The DuPont equation is an expression which breaks return on equity down into three parts. DuPonts analysis formula also known as the DuPont framework or DuPont equation is a useful investing technique to analyze a companys competitivenessIt allows you.

How To Create And Drive A Successful Peo Model With Optimal Results

The Dupont analysis also called the Dupont model is a financial ratio based on the return on equity ratio that is used to analyze a companys ability to increase its return on.

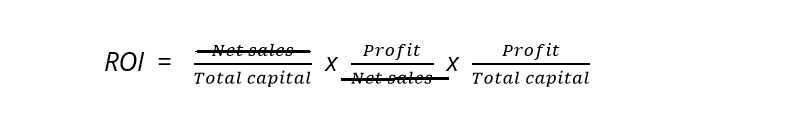

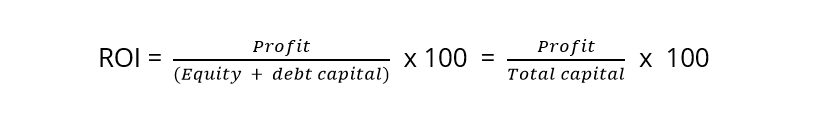

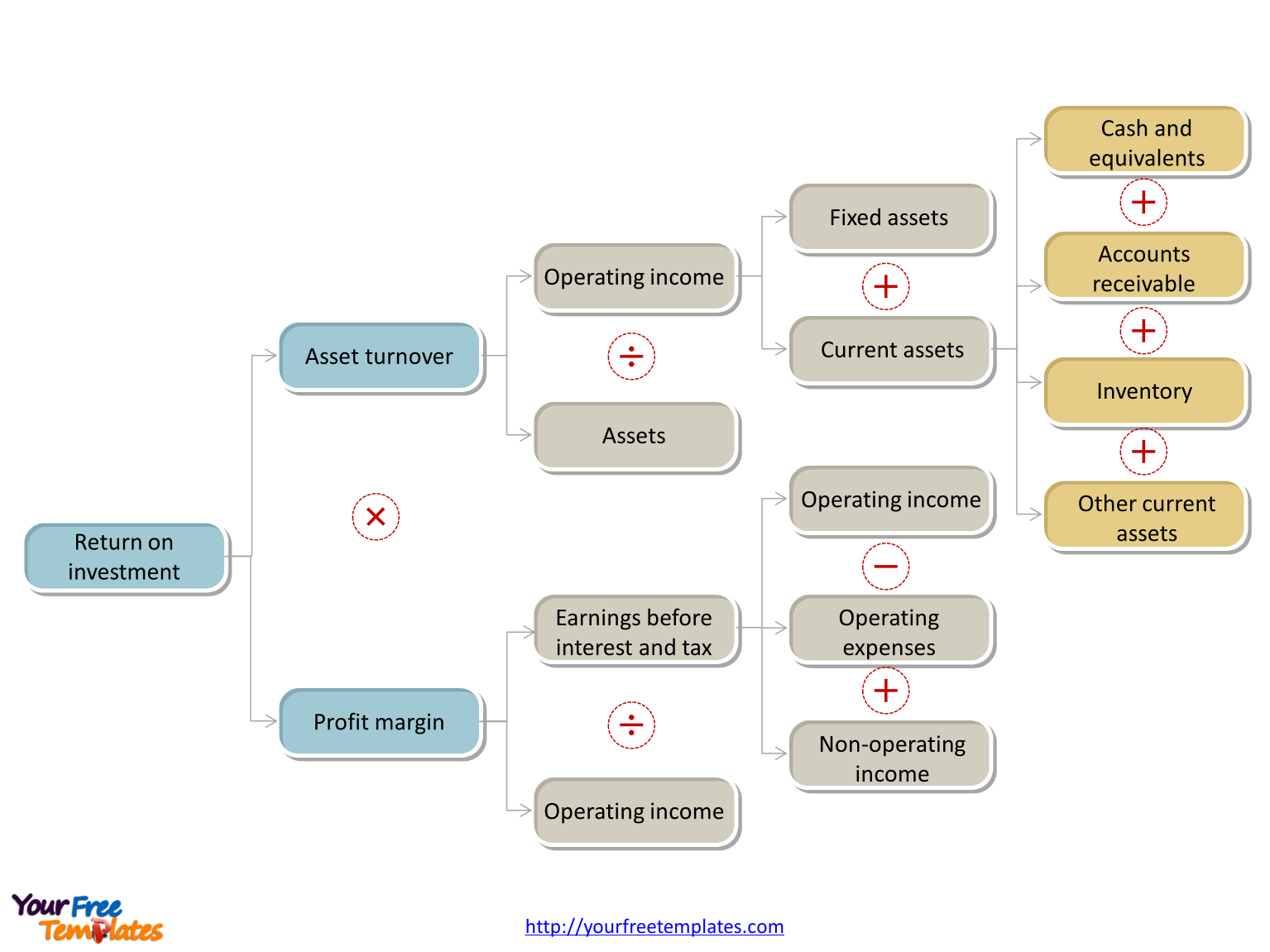

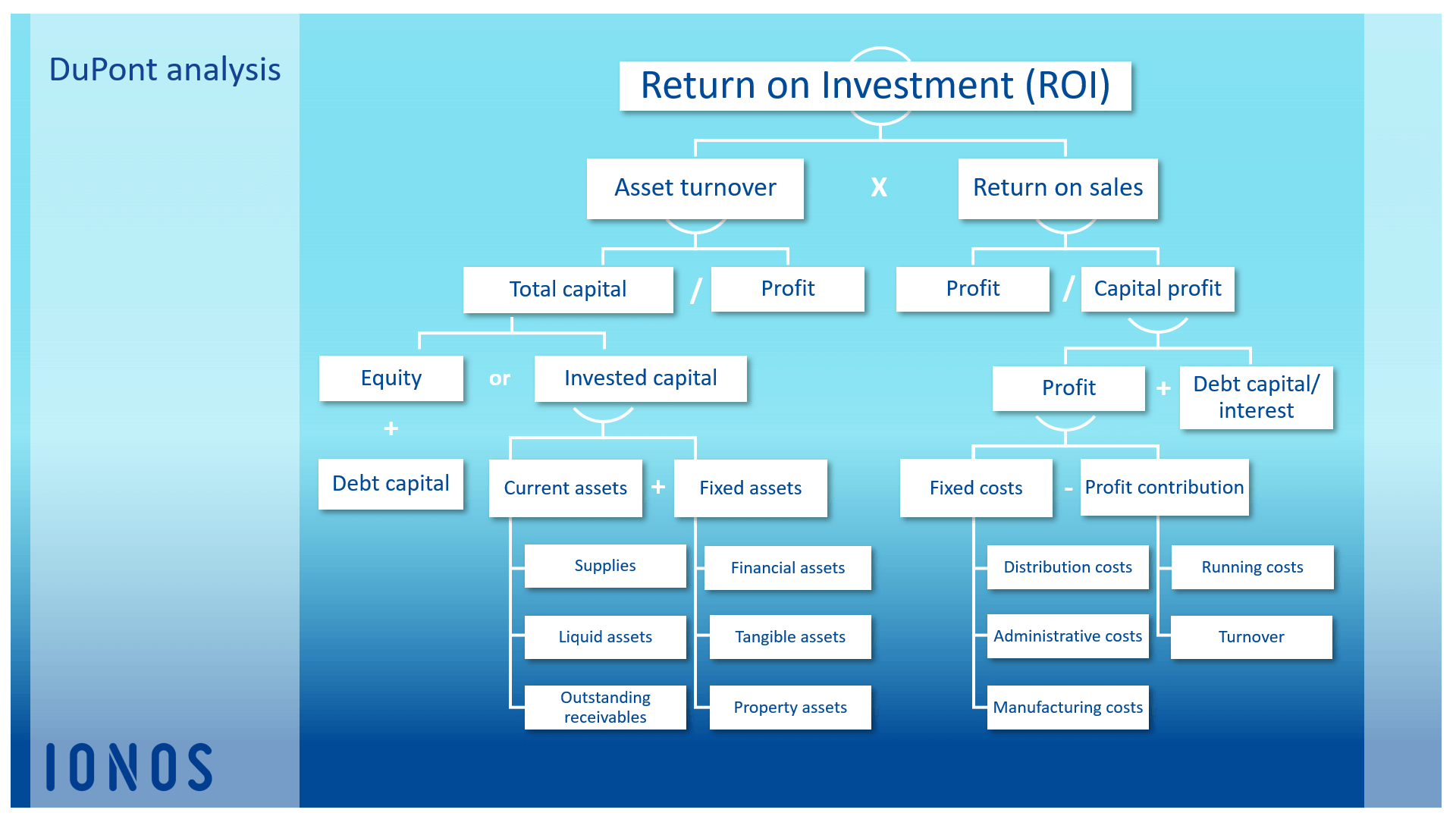

. Finally the investor uses the figures from each of their previous calculations to calculate each companys return on equity using the DuPont. DuPont analysis is an expression which breaks ROE Return On Equity into three parts. According to the DuPont model your companys ROI is calculated by multiplying its return on sales by its asset turnover.

In the 1920s the Dupont company developed a formula that is helpful in understanding how the different ratios from the income statement and balance sheet work together to produce the. Asset Turnover Revenue Average Total Assets. DuPont analysis ROE example.

In addition to indicating the return on investment ROI for shareholders DuPont analysis also factors in three important performance elements. The basic DuPont Analysis model is a method of breaking down the original equation for ROE into three components. Before we get to the equation I need to tall you the story of how the equation came about.

This website may use. DuPont analysis also known as the DuPont identity DuPont equation DuPont framework DuPont model or the DuPont method is an expression which breaks ROE return on equity into three. The name comes from the DuPont Corporation which created and implemented this formula into.

Multiplying the return on sales by the asset turnover. The DuPont Equation is one of the most important innovations in business. Operating efficiency asset efficiency and leverage.

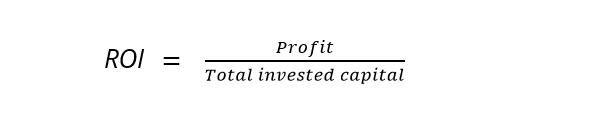

Asset use efficiency 3. Return on Investment ROI can be calculated using the DuPont formula. The five components of the 5-step DuPont formula are the following.

It uses the net profit margin and total asset turnover in the calculation of ROI. Tax Burden Net Income Pre-Tax Income. DuPont formula also known as the DuPont analysis DuPont Model DuPont equation or the DuPont method is a method for assessing a companys return on equity ROE breaking.

Proposed Analytical Framework To Assess Audit Risks

Dupont Analysis Wikiwand

Dupont Analysis Formula Breakdown And Calculator

Dupont Analysis Formula Breakdown And Calculator

Roi Return On Investment Definition Formula Calculation Ionos

Roi Return On Investment Definition Formula Calculation Ionos

Roi Return On Investment Definition Formula Calculation Ionos

Du Pont Roi Graphic

Pp Eye Dupont Analysis Roi Return On Investment Metrics

Dupont Analysis Roi Free Powerpoint Template

The Du Pont Return On Investment Formula Johnson And Kaplan 1987 The Download Scientific Diagram

Roi Return On Investment Unigiro Regtech

Dupont Analysis Formula Breakdown And Calculator

Dupont Roi Analysis Mba Boost

Roi Return On Investment Definition Formula Calculation Ionos

Dupont Formula And Equation Dupont Analysis

Dupont Analysis Formula Breakdown And Calculator